Wondering how to improve customer experience in insurance? Explore the must-have activities to conduct at early customer journey transformation stages and discover solutions to plan, analyze, and enhance customer experience in the insurance industry.

This article includes contributions from Stacy Dubovik, ScienceSoft’s Financial Technology Researcher, and Alex Bekker, ScienceSoft’s Head of Data Analytics Department.

In a digital insurance era with its spike in CX-native insurtech offers, staying content with a “good enough” customer experience leaves insurance carriers a small chance to survive. Fast-gaining competitive threats alongside evolving customer expectations raise the stakes for traditional insurers. The top-of-the-line digital customer experience (CX) becomes a way for insurers to stand out and secure business growth.

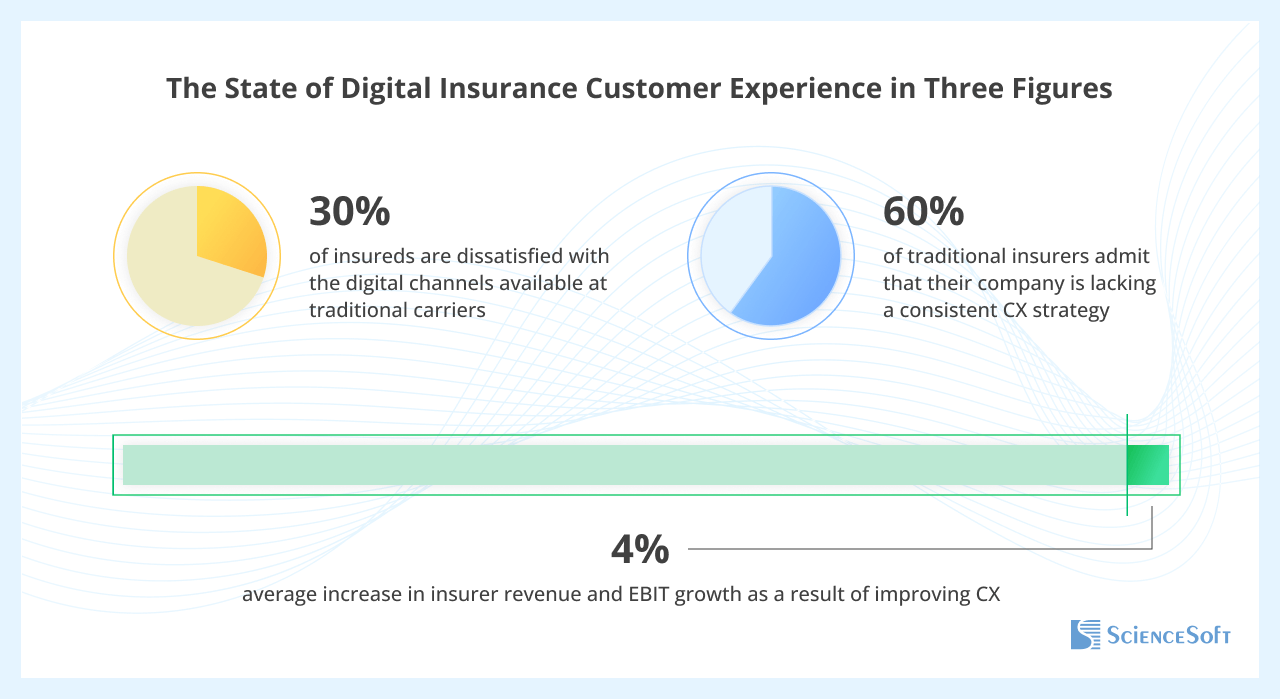

The specifics of insurance activities assume only 1–2 default customer-carrier interactions per year, which is way more scarce than in any other finance sector. Insurers need to make the most of each interaction. Recent sectoral stats reveal a clear financial value of giving CX the central place in an insurer’s strategic agenda. McKinsey estimates that insurance CX leaders (i.e., those with above-average CX scores) outperform the industry TSR benchmarks by 20–65% and harness on average 4% higher revenue and EBIT growth compared to those who scored average-to-low in CX. Some of ScienceSoft’s insurance clients I worked with managed to achieve an above-median increase in revenue and a decrease in customer churn alongside better employee efficiency, resulting in lower operational expenses.

While the zeal to improve insurance customer experience is evident, payers often have a vague idea of where to start the CX transformation and how to make the endeavor fuel long-lasting business success rather than fragmented incremental wins.

Looking back at my early-stage advice for insurance carriers, I compiled a comprehensive checklist of must-have activities to conduct at the digital CX discovery and CX transformation planning stages. This is not an ultimate guide to putting your specific things right. Still, matching your CX transformation planning activities against this field-tested handbook will help you ensure a steady, value-first digital CX improvement journey and sidestep costly pitfalls down the road.

Set Up the Processes and Tools to Recognize Customer Expectations

Customer feedback and insights into their experience with your digital platforms are vital indicators of how well your CX efforts are aligned with client needs. So, organizing a customer feedback loop and employing the right analytical tools is the starting point for any CX project. Below, I describe the steps and specialized tools to consider in order to understand insurance customer expectations.

Give your clients a voice

Implement customer feedback capabilities. It can be a widget, a button, or a dedicated section allowing users to share their thoughts quickly.

Customer surveys are a go-to technique to get a pulse on customer satisfaction with overall digital service quality and particular CX aspects like new or planned self-service features. Market-available tools like Typeform, Google Forms, and Qualtrics feature plenty of customizable templates to enable easy survey creation for non-tech employees.

Proactivity is the key to obtaining valuable insurance customer info, so send personalized emails and use push notifications to encourage customer feedback. Post-interaction follow-ups are perceived as more natural and less annoying than spot engagements amidst the policy period. The best time window to run feedback collection activities is within a week after a quoting, policy issuance, claim settlement, or other interaction. The clients would recall more service details and are more likely to share an objective opinion.

Keep an eye on web sentiment

Back in the day, sentiment analysis involved tiresome manual aggregation and processing of hundreds of customer reviews across disparate web sources. Advancements in AI-based NLP algorithms brought automation into the routine flow. Intelligent sentiment analysis software needs seconds to scan dozens of media data points, from reviews on Trustpilot to Instagram comments, and represent customer positives and negatives in the form of actionable insights for CX enhancement.

There are plenty of market-available tools to analyze web-wide company mentions and sentiment trends. I love OpenText, Lexalytics, and Brand24 for their rich BI capabilities that facilitate root cause and predictive analytics. Consider integrating sentiment analytics into your existing CX management app to automate sentiment-driven CX planning and optimization workflows. NLP leaders like Microsoft and IBM offer go-to APIs that help roll out AI-supported sentiment analysis features quickly and cost-effectively.

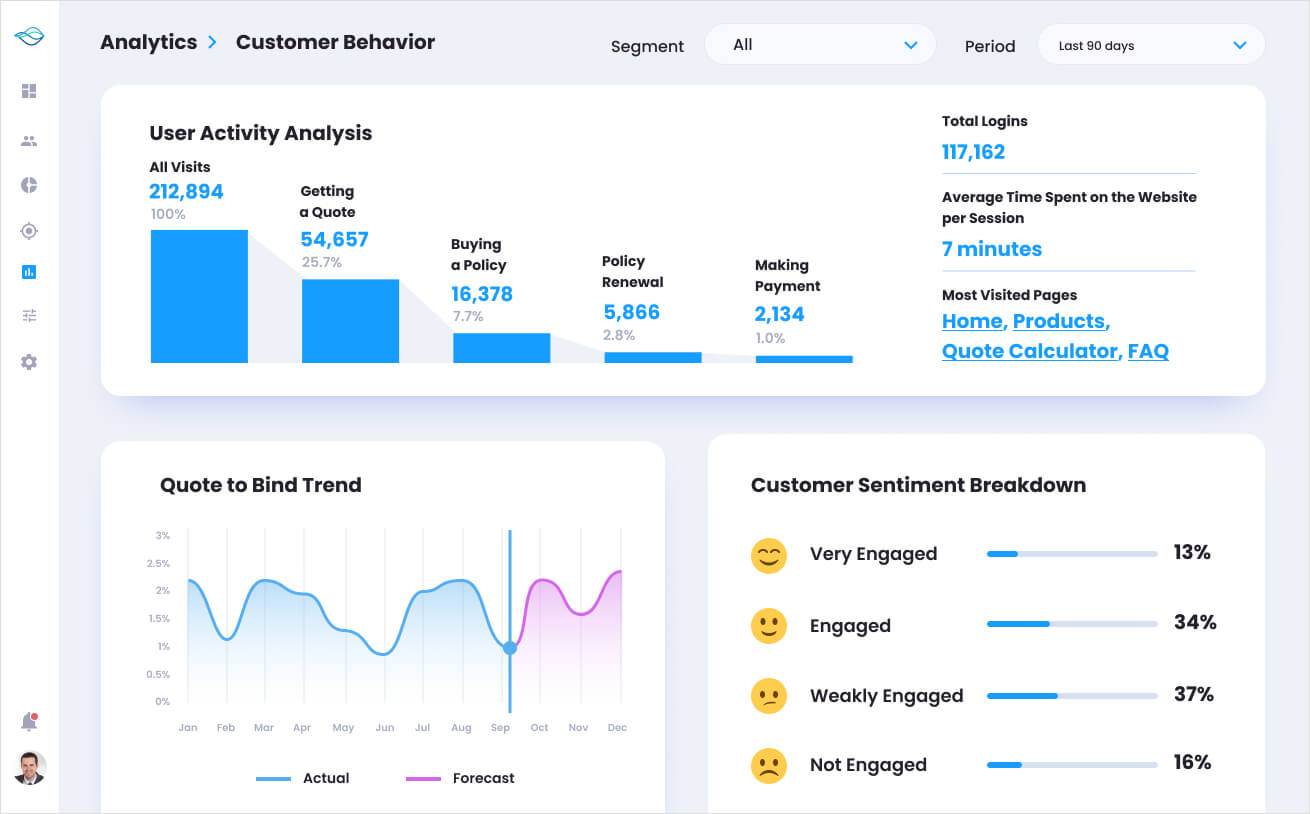

Get a close look into customer digital behavior

Implement user behavior analytics tools to understand how customers navigate and engage with your digital platforms over time. A combo of Google Analytics and Microsoft Clarity is a robust (and completely free) baseline stack that will give you a granular view of web and mobile user journeys, making it easy to assess the value of particular features, content pieces, and design options. The insights will help you define the areas of improvement and quickly evaluate change results. Adding custom behavioral analytics makes sense only if you have a large active customer base and want a sharp user segmentation by specific categories to streamline digital experience enhancements.

Sample dashboards from custom analytics software by ScienceSoft, for illustrative purposes only

Track the performance of your digital platforms

It’s essential to spot and resolve issues in the operation of your customer-facing apps before they invoke an avalanche of negative consequences. In some of my projects with ScienceSoft, my teammates used Firebase Analytics and Crashlytics to track and analyze insurance software performance and stability. Both tools are free and require bare minimum configuration.

Alex Bekker: You’ll likely need custom analytics to capture software-dependent metrics specific to your operations (e.g., quote generation speed or time to process client documents). This requires some development effort but will provide invaluable data for optimizing CX.

Ask front-line employees

Despite insurers’ aspiration to expand their digital presence, more than 70% of insurance customers still prefer in-person interaction with an agent for complex journeys like buying a policy or handling a claim. Hence, your agents are arguably the primary source of actionable insights when it comes to customer satisfaction, expectations, and digital adoption.

From my experience, close collaboration between the IT team, digital CX specialists, and insurance stakeholders helps sharpen digital CX requirements and drive a higher value of digital customer service strategies. Take care of collaboration tools to simplify remote feedback sharing and discussion for cross-functional teams. At ScienceSoft, we use the Atlassian stack (Confluence, Jira, Slack) as a default toolkit for change co-creation due to its convenience for non-tech parties.

Prioritize KPI-Based, Data-Driven CX Improvement Planning

An accurate insurance CX transformation plan is half the battle, albeit it’s easier said than done. My peers from The IBM Institute for Business Value give a market-wide angle: while 85% of insurance incumbents embrace digital CX initiatives to at least a moderate extent, 60% admit that their organization is lacking in a consistent CX strategy. The aspects I highlight below are the pillars of predictable and measurable CX improvements.

Bind digital CX to business value

I often tell my insurance clients that each digital CX initiative must be linked to strategic business priorities from the inception, and setting the appropriate result measurement framework is critical to proving the intended business value and winning stakeholder sponsorship. You need to obtain a clear vision – and, ideally, quantitative projections – into how your digital transformation endeavor will drive better CX, how the improved CX will affect CSAT, engagement, and loyalty, and how these will impact top-tier business outcomes like written premiums and profitability.

Your business and customer experience metrics may differ; I just give some sample KPIs to illustrate the idea of hierarchical multi-level dependencies:

|

Digital process efficiency |

Customer experience and attitude |

Customer behavior |

Insurer financial outcomes |

|---|---|---|---|

|

|

|

|

Right-size the focus

It may be tempting to get to all in one go, but making everything a priority unavoidably hinders the efficiency of CX endeavors. Rolling out several digital CX initiatives simultaneously complicates the evaluation of each initiative’s results. Not to mention it is incredibly resource-intensive and may become an unbearable burden. A wiser strategy would be narrowing the focus to one primary business-level outcome and driving digital CX improvements one by one, assessing the expected vs. actual results and tuning the rest of the planned activities for maximized value. For example, if your ultimate goal is driving revenue per client, focus on data-driven CX personalization to introduce lucrative upselling offers; if your priority is reducing acquisition costs, start with self-service options across insurance buying and claim filing and consider adding AI chatbots later on to streamline customer support.

Embrace data-driven planning

AI techs may not be as omnipotent as their evangelists claim, but machine learning is undoubtedly the king when it comes to diagnostic and predictive analytics. For you, employing ML-based diagnostic algorithms means the ability to analyze digital CX data from all available touchpoints and precisely evaluate the multi-level outcomes of your insurance CX initiatives. ML-powered forecasting tools offer vast capabilities for CX scenario modeling and can guide you on the appropriate action points. This helps prevent low-value efforts and prioritize improvements that promise the best possible outcomes.

Most market-leading customer analytics tools rely on ML and deliver beyond conventional statistical insights. Still, few accommodate insurance specifics, so be prepared to customize and configure a lot. An alternative is custom development. With the widening range of ML platforms (Amazon SageMaker, Azure Machine Learning, and Google’s Vertex AI, to name a few), rolling out custom ML analytics is no longer a matter of exorbitant expenses. Moreover, my estimates show that bespoke development is by far the most feasible option if you want to leverage AI with your existing analytics system. In ScienceSoft’s recent projects, we managed to deliver standalone ML components within the $30,000–$150,000 threshold.

Six Digital Customer Experience Strategies Insurance Companies Should Consider in 2025

While insurance customers eagerly try digital self-service options, the actual experiences often fall short of their expectations. Over 30% of customers are dissatisfied with the digital channels available at traditional insurance carriers, and the level of customer satisfaction (CSAT) with digital delivery in insurance is the lowest compared to other BFSI domains, meaning that the sector may be losing its clientele to insurtechs and finance giants. Neo-finance players set the new standard for client digital experience, and consumers today don’t expect less from insurers. So, a win-win strategy would be to look objectively at where your digital solution lags behind the leading e-insurance offers and first bridge the apparent gaps.

The following action points are a must to lay the foundation for winning insurance customer experience:

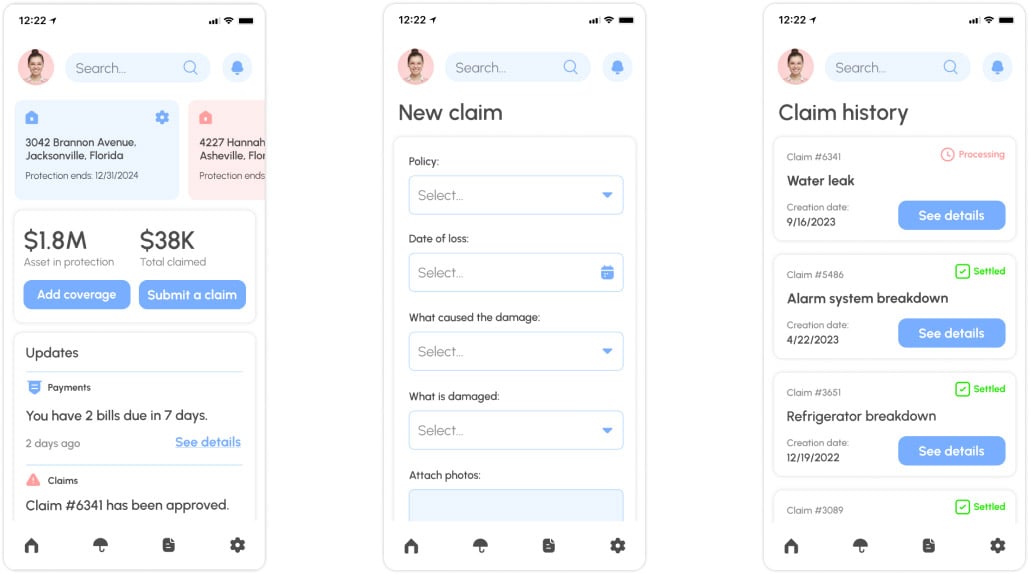

Offer self-service across the core insurance processes

With 80%+ of customers trying to solve the issues on their own before asking for help, empowering clients with self-service options becomes a must rather than a need for insurers looking to provide excellent client experience. Client-side functionality for quote calculation, onboarding, insurance application, premium payment, claim filing, policy renewal, and service progress tracking is the minimal loveable set to ensure consistent digital CX throughout the insurance life cycle.

Bring automation into the process to eliminate manual routines for your clients. For example, intelligent OCR and RPA techs help automate customer data capture from the submitted multi-format documents and insurance form auto-population with relevant details, making the data provisioning a matter of a few seconds.

Notably, offering self-service benefits both insurance customers and employees. One of ScienceSoft’s clients achieved a 50% reduction in staff workload and saw a 20% rise in employee satisfaction after equipping its clients with digital claim self-filing and claim resolution monitoring features.

Introduce mobile-friendly experiences

Launching a dedicated mobile insurance app is a proven way of CX improving, albeit you should expect to invest $120,000+ upfront. A more budget-friendly option would be implementing a web portal with a responsive design (or converting your existing web platform into a responsive layout). The alternative goes without CX tradeoffs: a mobile-responsive solution offers the same functional scope and visual looks across all devices.

Sample interfaces of a homeowner insurance mobile app by ScienceSoft

Provide personalized user journeys

There’s no one-size-fits-all option to address the demands of heterogeneous insurance clientele, and providing a personalized customer journey is the only viable technique to maximize digital service value for each particular client. Notably, roughly 60% of consumers believe businesses should use the data they collect about them to personalize their experiences, so the expectation bar is high. Luckily, so are the gains: investments in personalized customer service strategies and tailor-made insurance products pay off as an 80%+ increase in customer retention, up to 90% higher engagement, and reduced client acquisition costs.

Behavioral analytics tools like Google Analytics, Mixpanel, and Microsoft Clarity can aid in tracking major customer experience metrics and segmenting your audience based on shared characteristics across geographic location, demographics, engagement, loyalty, and more. Converting each segment into a customer persona and mapping a dedicated user journey helps easier plan customized content and compile rules for dynamic content optimization quicker. Major insurtech players went beyond segmented paths and trailblazed AI-based contextual and prescriptive customer analytics to deliver hyperpersonalized CX. Custom AI algorithms help tailor landing page contents, search results, and product recommendations to the preferences and actions of each visitor on the fly, ensuring maximized relevance of the offer and improved engagement.

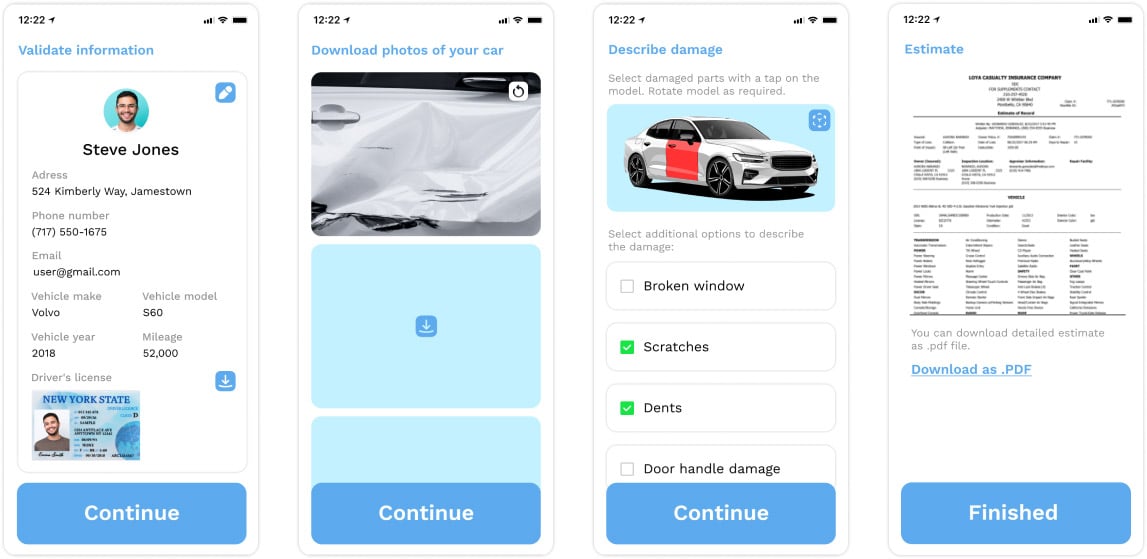

Prioritize intuitive UX/UI

After 11 years in the insurance IT consulting field, I can say confidently: poor app usability is the primary insurance CX disruptor and the main barrier to user adoption. Due to the domain’s complexity and specificity, digital insurance purchasing and claim filing processes may seem intimidating per se. If your solution inherits the complexity, chances are, your clients will go a good old path and interact with an agent, which obviously contradicts your goals.

Opt for straightforward and clear UX. Do not overload pages with UI elements and balance the screen contents via hidden dropdowns and popups. Also, be careful with aesthetics: while the app’s catchy visual appearance contributes to brand awareness, it may overwhelm insurance customers, who mostly turn to the app in situations of perplexity and distress. A neutral color palette and laconic UI elements would be the safest choice.

Sample interfaces of an auto insurance app by ScienceSoft

Educate your clients

In a physical environment, educating and informing insurance clients stays on the agent and advisor side. Digital customers are to navigate the complexity by themselves, so giving them access to abundant, transparent, and easy-to-understand information about insurance products is essential. By providing content on key insurance concepts, risk evaluation models, and claims processes, you allow your clients to understand the value of your proposition better and make more informed decisions. Also, consider providing your clients with a knowledge base on risk mitigation and loss prevention. It will demonstrate your commitment to client well-being and contribute to customer trust.

Remember that your knowledge repository should be easily accessible via digital channels. Showcasing the educational content section in the website or app menu and implementing quick search functionality will help your prospects find what they are looking for without hassle.

Stacy Dubovik: A combo of IoT and intelligent contextual analytics opens up the opportunity for proactive insurance customer guidance on loss prevention. AI can analyze real-time data from connected consumer wearables, vehicle devices, and enterprise systems of business insurance clients, instantly spot risky events, and notify customers of the appropriate steps to avoid losses. You kill two birds with one stone, both driving better CX and minimizing claim payouts.

Leverage AI-powered virtual assistants

In the insurance industry, advisory is an integral part of every customer interaction, so it’s critical that your digital customers quickly get a helping hand at any stage of their journey. Employing AI-powered virtual assistants helps ensure 24/7 immediate responses to common customer inquiries and introduces basic guidance through the policy purchasing and claim submission processes. Advanced assistants powered by LLMs are carrying the day in insurance customer experience trends. Such solutions can process up to 80% of queries outright; the rest are routed to human agents who can engage in real-time conversation and help clients navigate complex and non-standard issues. While 29% of customers say bots are ineffective, insurers that use smart advisors report, on average, a 7% increase in CSAT.

A note on successful implementation: care about thoroughly training the bot’s underlying conversational model to ensure accurate and unbiased responses. Model training on your company’s proprietary data will help accommodate the specifics of your insurance offer and maximize the relevance of AI-supported advice.

Be Patient and Consistent to Succeed in the Long-Term CX Endeavor

The insurance industry is moving to the digital rails rapidly, and it’s high time to start your digital CX transformation initiative to retain and grow the market share. Despite the clear urgency, I always warn my customers against setting up for quick wins. From my practice, an insurance CX transformation project may take 9–20 months, and the sense of immediate priority must be sustained through the entire journey to keep the steady change pace.

Once you have the plan to act confidently, the courage and resources to move ahead, the toolkit to quickly grasp evolving customer expectations, and the agility to adapt to them down the road, excelling at digital CX is only a matter of time. And I hope that my advice will help you lay a firm foundation for success.

Whether you are launching a new client-facing insurance solution, improving customer experience across your existing apps, or have any other questions about how to improve CX in insurance, feel free to schedule a consultation with me or other ScienceSoft’s specialists.

[ad_2]

Source link