After a down year for open radio access networks in 2024, mobile operators worldwide hope that multivendor products based on open interfaces will finally let them tap the architecture’s potential.

What is Open RAN?

Open RAN is a broad movement that seeks to virtualize RAN functions with standardized interfaces. The goal is to let operators use common, off-the-shelf hardware from a variety of vendors to deliver their services.

The standardization effort is led by the O-RAN Alliance, an international community of mobile network operators, vendors, and research and academic institutions that launched in 2018. Major backers include AT&T, China Mobile, Deutsche Telekom, NTT Docomo and Orange.

Operator Benefits

By allowing more vendors to sell their products to operators, Open RAN’s backers hope to speed up the deployment of 5G networks. They say proprietary RANs choke technological breakthroughs because operators can buy RAN equipment from only a select number of suppliers whose respective products are incompatible.

The Open RAN movement has come a long way in just a few years, but with mixed results. Open RAN today accounts for only a small share of the broader RAN market, according to Dell’Oro Group Vice President Stefan Pongratz. But, he said, “The pipeline is improving, and leading operators and suppliers are embracing the movement.”

With three out of the top five RAN vendors already supporting the initiative, he said it’s no longer a question whether operators will adopt the O-RAN fronthaul interface.

“The fundamental question now is more about the timing and the adoption curve for the various RAN segments,” Pongratz said.

Open RAN Tanked in 2024

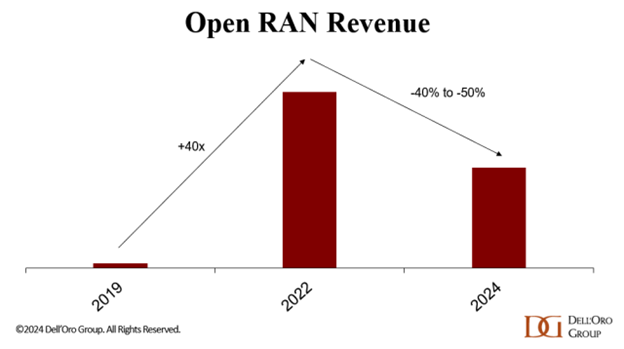

Open RAN spending ramped up sharply between 2019 and 2022 but fell by $500 million in 2023, as activity in the U.S slowed. Expenditures plummeted 30% in 2024, partly driven by the state of 5G development in Japan and the U.S.

Dell’Oro said another contributing factor was the commercial readiness of next-generation O-RAN uplink performance improvement (ULPI) technologies. As a result, Pongratz said the Open RAN market is now projected to take up a single-digit share of the 2024 market, with 8% to 10% combined with proprietary and Open RAN 2025 revenue.

“With large-scale greenfield deployments now mostly in the past, the broader market sentiment will remain uncertain until 5G activity in the U.S. and Japan improves, or modernization projects utilizing the latest O-RAN ULPI interfaces firm up,” Pongratz said.

Newer Interfaces to Drive Open RAN

One such ULPI interface is the Cat-B Uplink Performance Improvement Interface. The standard enables mobile deployments in dense environments, such as multiple input, multiple output (MIMO) networks, and represents a vast advancement from the earlier standard. With Cat-B, proponents say it’s possible to implement Open RAN at scale and with optimal fronthaul costs — all without compromising performance.

Yet, new interfaces are only part of the challenge the Open RAN market faces. Well-defined, standardized interfaces are needed for equipment from different vendors to communicate as part of Open RAN’s disaggregation of network elements, according to National Institute of Standards and Technology, a member of the O-RAN Alliance. Furthermore, increased network complexity and the need for real-time control will force network operators to investigate automated tools based on machine learning algorithms.

O-RAN PlugFest: Works in Progress

In 2024, the O-RAN Alliance sponsored its PlugFest event in Germany to usher in additional technological RAN advancements. Those advancements included:

-

Performance improvements of open and interoperable RAN in combination with intelligent network management functions, based on near-real-time and non-real-time RAN intelligent controllers (RICs).

-

RICs newly developed by providers, operators and academic institutions.

-

Network energy savings measured by ETSI energy efficiency test specifications.

-

More providers showcasing O-RAN conformance and interoperability testing of products.

[ad_2]

Source link